comes with a full suite of budgeting tools that you can use to create your budget and achieve your financial goals. If you can measure it, you can manage it - and the tools listed above will help you do both. No matter whether your household is filled with financial gurus or first-time budgeters, the tools outlined here will help. This includes budgeting, invoicing, expense tracking, and.

#BUDGETING TOOL SOFTWARE#

Xero is a cloud-based accounting software for small business owners to manage their finances. Both will prove essential your business for months and years to come. You can set up a calendar reminder to review at the same time each month, or you can use a tool like Mint to keep you constantly in sync. These tools often integrate into your budgeting and accounting tool but have stronger forecasting features. You need to review your budget frequently, comparing it to what you’ve actually spent. Not only does this help you stay on top of your budget, it also prevents a collection of receipts from building up in your wallet.Ī budget is not a “set it and forget it” exercise. If you own a smartphone or tablet, it helps to have access to your budget from your device, so you can keep your accounts up to date, no matter where you are. Besides, it offers various add-ons for payroll, credit card processing, and other business necessities. Sage 50cloud is an online accounting tool that helps you manage your accounting, cash flow, invoicing, taxes, inventory, and so on. Whether you use a service like Mint (which offers e-mail and text reminders), or your own calendar system, develop a way to remind yourself when bills are due, so you can avoid late fees and unnecessary interest payments. When choosing our top five, we identified three types of budgeting tool categories: spreadsheets, desktop software and smartphone apps. Best for: small and medium-sized businesses. Both the site and app are intuitive to use, but Simplifi offers a very capable chat function that. Websites like Mint let you easily enter each transaction, allowing you to see where your money is going, what’s in your accounts, and what you owe. Simplifi’s goals feature was the easiest to use of the budgeting apps that accounted for goals. Financial tracking software like helps you do that by organizing and categorizing your spending, then helping you set up your financial goals.ĭevelop a system so that whenever you spend money, you can record the amount going out, and the budget category.

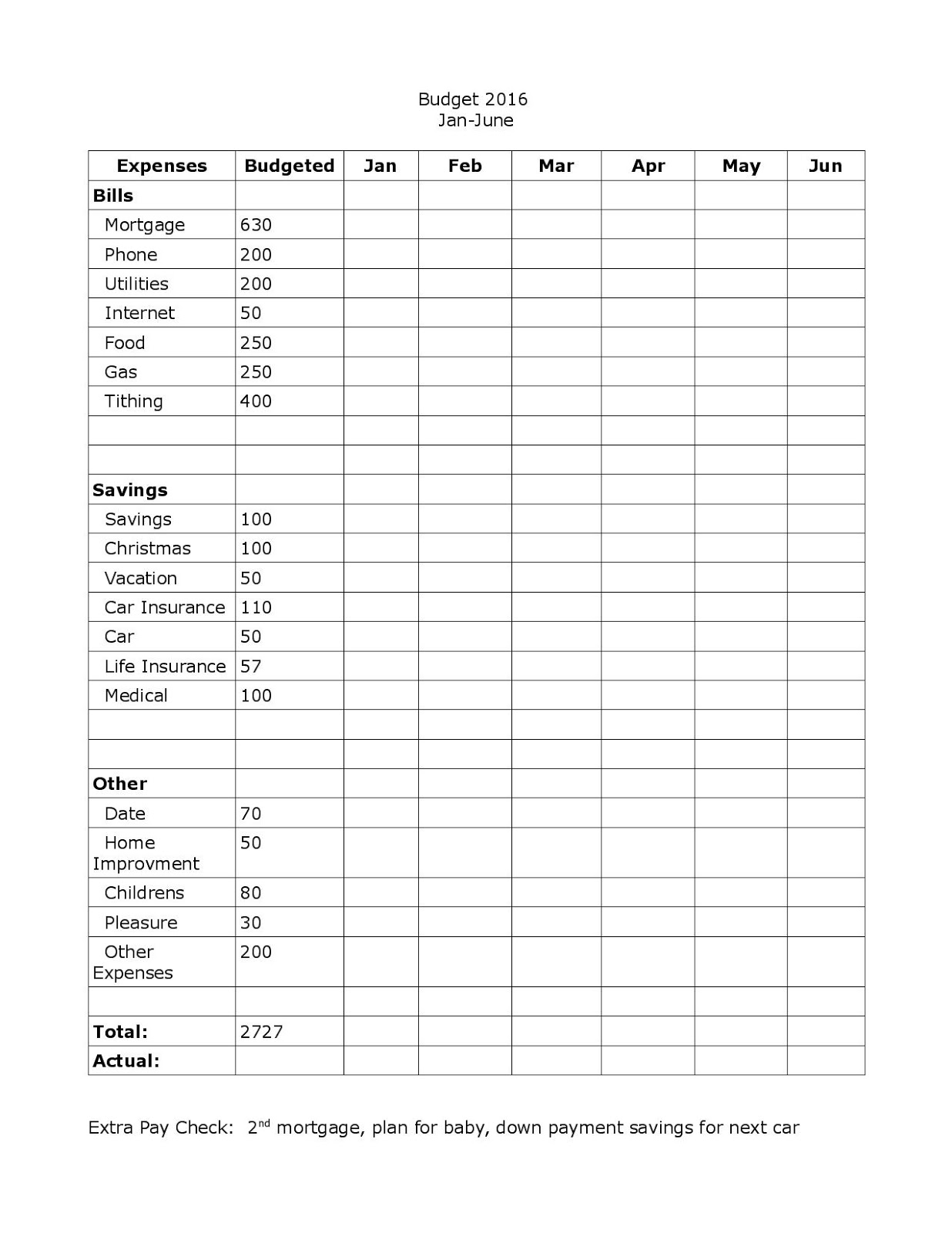

The first step to making a budget is to figure out what you’re earning and what you’re spending. Here are some of our recommended budgeting tools to help you achieve your financial goals. We want you to stay on track for the long haul, well after the initial excitement of creating a budget has worn off. See a great visual picture of where you are spending money, all generated from the categories you create.At Mint, we’re interested in helping you create a budget that actually works. Search your history by any field such as category, label, description, date and dollar amount. These items will all be reflected in your balance helping you know what funds are available to you and giving you piece of mind that you won’t over spend. Stay on top of your available balance by entering pending checks, income and expenses. Know your account balance now and into the future by seeing upcoming transfers and Web Payments in your Account History. Know when a particular check clears, when a deposit over a certain amount occurs and when a transaction posts from a certain store. Labels - Create another layer of information for your transactions by tracking spending for different members of your family or an event.Notes - Add personalized messages to your transactions.Categories - Assign or automatically assign categories to transactions such as home, bills and utilities, income and more.Three Reasons to Open a Traditional or Roth IRAĮxplore all the budgeting tools and resources available to you in Web Branch and our Mobile App, including: Categories, Notes & Labels Consolidating Credit Card Debt with a Balance Transfer

0 kommentar(er)

0 kommentar(er)